Why Calculating Your Tax Return Matters

Every year, tax season brings mixed emotions for individuals and businesses alike. Some people hope for a tax refund, while others worry about paying extra tax at the end of the year. The uncertainty around tax return outcomes often makes financial planning stressful.

Many taxpayers prefer to calculate tax return figures before filing so they can stay prepared rather than surprised. Using the right tools early helps you understand your tax position, manage finances better, and feel confident about decisions related to budgeting, savings, and future decisions. When you plan ahead, you gain clarity over income, deductions, and payable tax, making the entire filing process smoother and more predictable.

What a Tax Return Calculator Does ?

A Tax Return Calculator is a digital solution designed to help individuals estimate their tax return estimates before officially filing. It considers your income, deductions, and super contributions to show whether you may receive a refund or face tax refund payable.

For people living in Australia, a Tax Return Calculator in Australia is built around local tax laws, making it relevant for every employee, freelancer, contractor, and business owner. It also works as a tax return estimator by applying current ATO tax brackets and official rules, giving users a clearer view of their financial situation without complex manual calculations.

How to Calculate Australia Tax Return Step by Step ?

Single person, annual income AUD 60,000 + other income AUD 2,500, tax withheld included → Estimated Net Annual Income: AUD 52,164 (approx.)

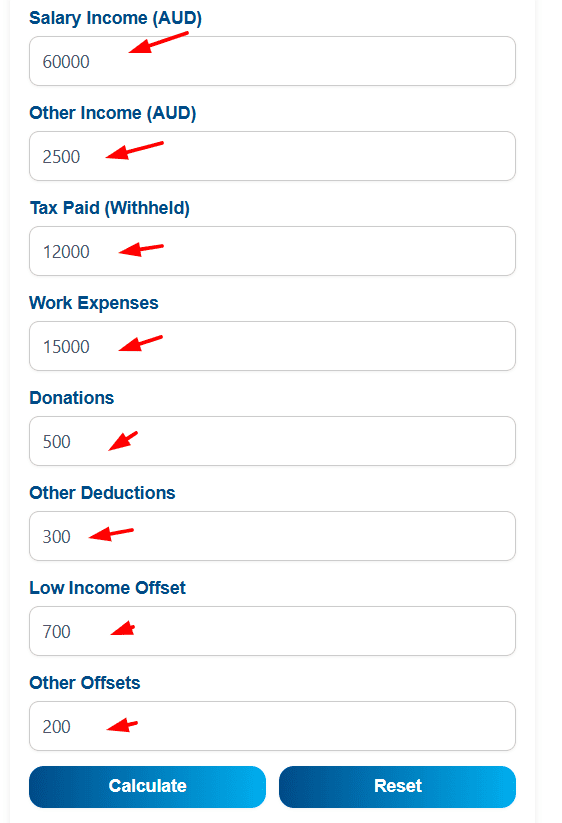

Step 1: Enter Salary Income

Input: AUD 60,000

This is your main annual salary before tax.

Step 2: Enter Other Income

Input: AUD 2,500

Additional income such as interest or side income.

If none, enter 0.

Step 3: Enter Tax Paid (Withheld)

Input: AUD 12,000

This is the tax already deducted by your employer.

Step 4: Enter Work Expenses

Input: AUD 1,500

Job-related expenses you are claiming.

Step 5: Enter Donations

Input: AUD 500

Approved charitable donations.

Step 6: Enter Other Deductions

Input: AUD 300

Any additional allowable deductions.

Step 7: Enter Low Income Offset

Input: AUD 700

Applicable low income tax offset.

If not applicable, enter 0.

Step 8: Enter Other Offsets

Input: AUD 200

Any other tax offsets.

Step 9: Click on “Calculate”

The calculator automatically computes tax and refund based on Australian tax brackets and Medicare levy.

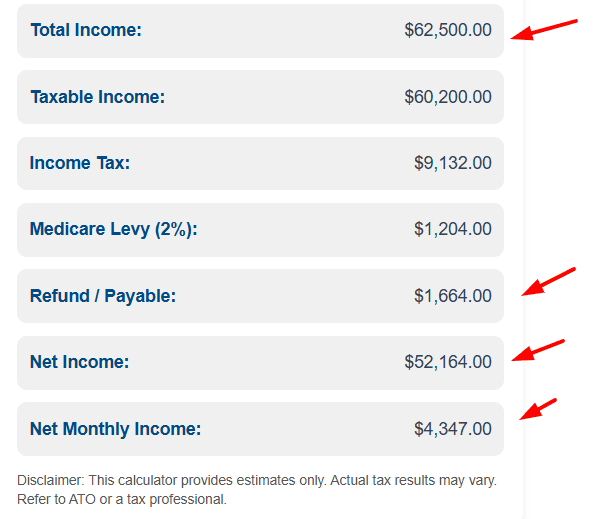

Calculator Output (Result)

Total Income: AUD 62,500

Total Deductions: AUD 2,300

Taxable Income: AUD 60,200

Income Tax (after offsets): AUD 9,132

Medicare Levy (2%): AUD 1,204

Total Tax: AUD 10,336

✅ Refund Amount: AUD 1,664

(because tax paid was higher than total tax)

✅ Net Annual Income: AUD 52,164

✅ Net Monthly Income: AUD 4,347

Notice: This calculator provides estimates only.

Common Scenarios and Planning Ahead

Different taxpayers face different scenarios. A casual worker may want to understand take-home pay fluctuations, while a self-employed individual or self-employed person often focuses on taxable income after expenses. Employees usually compare results with Simple Salary Calculators or a Take Home Pay Calculator to align their take-home pay expectations.

Business owners and contractors often rely on an Australian Tax Return Calculator to forecast tax returns estimate and plan cash flow. Using tools early supports planning ahead, reduces last-minute stress, and helps align tax decisions with long-term financial goals. For related insights, users often explore a detailed salary tax planning calculator to understand broader income impacts.

Benefits of Using a Tax Return Calculator

Using a calculator for tax refund planning offers clarity and control. Instead of guessing outcomes, you get a realistic view of payable tax or refunds based on official formulas. A simple tax return calculator allows users to test scenarios, adjust deductions, and see how small changes affect results.

This is especially helpful when estimating super contributions or reviewing tax return Australia calculator outcomes. It also helps users stay aligned with Australian Taxation Office (ATO) updates and avoid surprises during filing. By using estimate my tax return tools early, individuals can manage budgets more effectively, set aside funds if needed, and feel confident that their tax information aligns with current laws.

Common Missteps to Avoid

Many users forget to include all income types, leading to inaccurate results. Others overlook eligible deductions or rely on outdated tools that do not reflect income tax return calculator 2025 standards. Ignoring updates from the Australian Taxation Office (ATO) or misunderstanding official rules can also skew outcomes. Always double-check figures before submission.

FAQs

Q:1- Are tax return calculators accurate in Australia?

A:- Yes, when a tool follows ATO tax brackets and current regulations, results from a tax return estimator Australia or australian tax return estimator are generally reliable, though final assessments may differ.

Q:2- Can I use these tools if I am self-employed?

A:- Absolutely, they help estimate tax returns by considering business expenses and deductions.

Q:3- Is it possible to estimate tax return before filing?

A:- Yes, tools designed to estimate tax return or estimate tax returns give early clarity.

Q:4- Are online calculators free to use?

A:- Most estimate my tax return calculator tools are free and easy to access.

Q:5- Do calculators include Medicare Levy and PAYG?

A:- Many tools automatically factor in Medicare Levy and PAYG instalments.

Q:6- Where can I find official tax guidance?

A:- You should always verify details on the official website: ato.gov.au

Q:7- Can these tools help with long-term planning?

A:- Yes, they support tax returns estimate accuracy and better financial planning over time.

Q8: What steps should I follow to calculate my tax return?

A: Enter annual earnings from different income sources and include eligible deductions to follow tax rules for a complete tax return calculation.

Q9: Are additional payments like Medicare or PAYG included?

A: Yes, the calculator can account for Medicare Levy, PAYG instalments, and tax already paid during the year.

Q10: What is a Tax Refund Estimator?

A: A Tax Refund Estimator is a tool that helps you calculate the amount of refund you may receive from the ATO before filing your tax return. It provides an approximate figure based on your income, deductions, and offsets.

Q11: How do I use a Tax Refund Estimator Calculator?

A: To use a Tax Refund Estimator Calculator, enter your salary, other income, tax paid, and any deductions. The calculator then provides an estimated tax refund you can expect, making planning easier.

Q12: Can I rely on an Estimated Tax Refund Calculator for planning?

A: Yes, an Estimated Tax Refund Calculator gives a close approximation of your refund. While the final amount may vary after filing, it is useful for budgeting and understanding your potential tax outcome.

Q13: What if I only want an Approximate Tax Refund before filing?

A: You can use tools labeled as Approximate Tax Refund calculators or Tax Refund Estimator tools to quickly see a rough refund figure. These tools are helpful for early financial planning and avoiding surprises during tax season.

Q14: How does this tool help me prepare for filing?

A: It allows you to estimate tax return figures, prepare confidently, and simplify lodging your tax return.