Taxable Income after Salary Sacrifice:

Employer Super Contribution:

Estimated Tax Savings:

Salary Sacrifice & Tax Planning Calculator

A Salary Sacrifice & Tax Planning Calculator is a smart financial tool designed to help employees understand how salary sacrifice and tax planning can improve tax efficiency, reduce taxable income, and increase take-home pay.

By combining salary packaging options with accurate income tax calculation software, this calculator gives quick and reliable insights into salary structure, tax deductions, and long-term savings while supporting better financial planning in Australia.

Whether you use a salary packaging calculator ATO or a salary package calculator Australia, these tools make it easier to see the financial impact of your choices.

What is Salary Sacrifice Calculator ?

What is salary sacrifice calculator? A Salary Sacrifice Calculator allows you to estimate how pre-tax income can be redirected into employee benefits such as super contributions, novated car leasing, laptops salary sacrifice, or other salary sacrifice benefits.

In salary sacrifice Australia, part of your annual income is packaged before tax, which may lead to tax reduction, tax savings, and improved overall pay structure. Many professionals use a salary packaging calculator alongside a payroll tax calculator to see the salary sacrifice effect on take-home pay and salary sacrifice tax impact clearly.

How to calculate Salary Sacrifice Calculator step by step ?

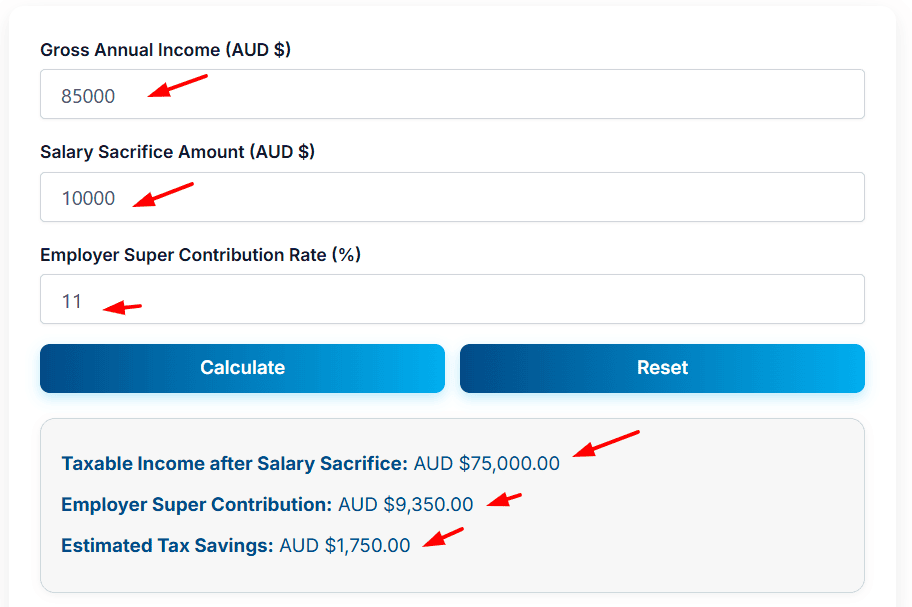

Suppose: A user has a gross annual income of AUD $85,000, wants to salary sacrifice AUD $10,000, has an employer super contribution rate of 11% — what would be their taxable income, super contributions, and estimated tax savings?

Input Values (Form Filled Example / Image Reference):

- Gross Annual Income: AUD $85,000

- Salary Sacrifice Amount: AUD $10,000

- Employer Super Contribution Rate: 11%

Step 1: Calculate Taxable Income After Salary Sacrifice

- Formula: Gross Income − Salary Sacrifice

- Calculation: 85,000 − 10,000 = AUD $75,000

Step 2: Calculate Employer Super Contribution

- Formula: Gross Income × Super Rate

- Calculation: 85,000 × 11% = AUD $9,350

Step 3: Estimate Tax Savings

- Example marginal rate: 32.5%

- Tax savings formula: Salary Sacrifice × (Marginal Rate − 15%)

- Calculation: 10,000 × (32.5 − 15)/100 = AUD $1,750

Step 4: Display Results

- Taxable Income after Salary Sacrifice: AUD $75,000

- Employer Super Contribution: AUD $9,350

- Estimated Tax Savings: AUD $1,750

Step 5: Reset (Optional)

- Clears all fields to calculate a new scenario.

Notice: Estimates only. Actual tax and super contributions may vary. Consult a financial advisor for accuracy.

How Salary Sacrifice Works in Australia ?

How salary sacrifice works in Australia is simple but powerful. You agree with your employer to reduce your gross salary and allocate that amount toward benefits like super contribution calculator estimates, novated lease options, or car leasing.

This reduces taxable income and can improve tax planning outcomes. A Salary Sacrifice / Tax Planning Calculator integrates payroll tax calculation, payroll obligations, and deductions impact with salary income tax software to show benefits interaction across your salary structure.

Tools verified by trusted sources such as the Australian Tax Office (ATO) and ATO salary sacrifice calculator logic ensure accurate financial calculators for income planning and payroll review.

Why Use Salary Sacrifice & Tax Planning Calculator ?

Is salary sacrifice worth it? For many Australians, yes. A Tax Planning Calculator helps analyze salary sacrifice amounts, salary sacrifice impact, and salary sacrifice super impact, making it easier to align salary sacrifice strategy with financial goals.

This calculator works as a tax planning tool and financial planning tool by combining salary and tax tools, compound interest calculator logic for quick growth estimates of super balance, and insights into tax and deductions.

Platforms like Simple Salary Calculators offer easy financial calculators, up-to-date financial calculators, and Australian financial calculators that act as a trusted source for smart financial decisions. For official guidance, users can also refer to the Australian Tax Office website ato.gov.au

as an outbound reference. Internal comparisons with tools such as income tax calculators and payroll calculators within Simple Salary Calculators help users understand Australia salary sacrifice planning better.

FAQS

Q1: What is salary sacrifice calculator used for?

A- It is used to estimate how salary sacrifice planning affects taxable income, take-home pay calculation, payroll tax, tax deductions, and long-term savings in Australia.

Q2: Is salary sacrifice worth it in Australia?

A- Salary sacrifice can be worth it depending on your income level, chosen benefits, salary structure, and tax planning goals, as it may reduce taxable income and improve tax efficiency.

Q3: How does salary sacrifice impact super contributions?

A- Salary sacrifice super contributions are paid from pre-tax income, which can help grow super balance over time and support long-term financial planning using compound interest calculations.

Q4: Does salary sacrifice affect payroll and tax calculations?

A- Yes, salary sacrifice payroll impact can change payroll tax calculation, payroll obligations, and overall pay structure, which is managed through salary income tax calculation software.