Disclaimer: This calculator provides estimates only and is not financial advice. Actual repayments may vary based on lender terms and personal circumstances.

Australian Mortgage Calculator

Buying a home is one of the biggest financial decisions Australians make, and it often starts with understanding affordability. Before speaking to lenders or agents, people want clarity on repayments, income capacity, and long-term impact.

That’s where smart calculation tools make a difference. By combining income insights, expense planning, and borrowing estimates, users can make confident decisions without stress. Whether you’re planning your first purchase or reassessing an existing loan, clear calculations help reduce uncertainty.

With the rise of technology-driven financial tools, Australians now expect instant results, realistic projections, and easy planning—without complicated formulas or guesswork.

What Is an Australian Mortgage Calculator

An Australian Mortgage Calculator is a digital solution designed to estimate home loan repayments based on loan amount, interest rate, and loan term. It helps Australian users understand how much they may need to pay weekly, monthly, or annually,

while aligning repayments with actual income. Many people also pair it with salary calculation software to see how employee pay, wages, deductions, taxes, and net salary interact with mortgage commitments.

This approach supports better payroll management, clearer salary details, and smarter financial rules under Australian tax systems.

How To Use Australian Mortgage Calculator – Step-by-Step ?

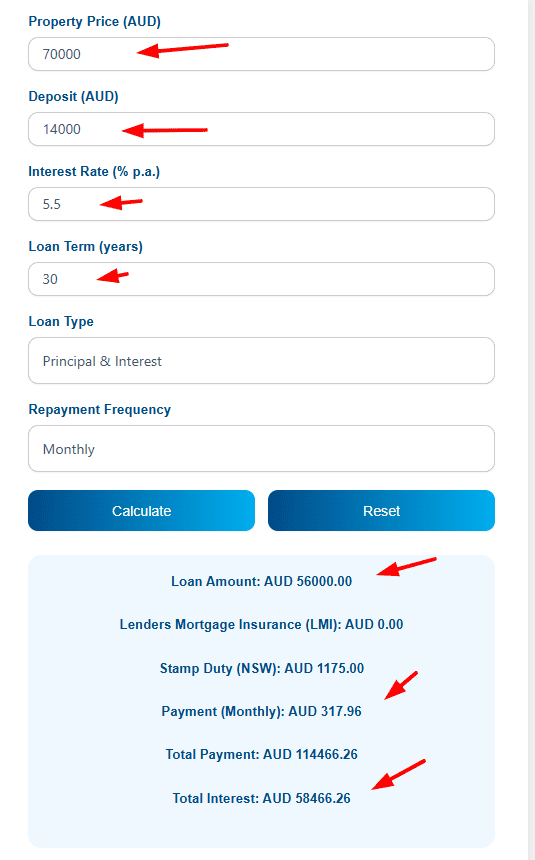

Suppose: a buyer wants to purchase a property in Australia priced at AUD 700,000. The buyer pays a deposit of AUD 140,000, chooses a home loan with an annual interest rate of 5.5%, a loan term of 30 years, and selects a Principal & Interest loan with monthly repayments.

Step 1: Enter Property Price

Property Price: AUD 700,000

Step 2: Enter Deposit Amount

Deposit: AUD 140,000

Step 3: Enter Interest Rate

Interest Rate: 5.5% per annum

Step 4: Enter Loan Term

Loan Term: 30 years

Step 5: Select Loan Type

Loan Type: Principal & Interest (P&I) – Each repayment gradually reduces the loan balance while covering interest costs.

Step 6: Select Repayment Frequency

Repayment Frequency: Monthly

Step 7: Click Calculate

Press Calculate to see your estimated mortgage results.

Step 8: View Results

After calculation, the calculator shows:

- Loan Amount: AUD 56000.00

- Lenders Mortgage Insurance (LMI): AUD 0.00

- Stamp Duty (NSW): AUD 1175.00

- Payment (Monthly): AUD 317.96

- Total Payment: AUD 114466.26

- Total Interest: AUD 58466.26

Notice: Calculator results depend on the values you enter. Article examples are for illustration only, and actual figures may vary when inputs change.

Common Scenarios and Planning Ahead

Many Australians use calculators when planning upgrades, switching lenders, or balancing rent versus buying. By reviewing gross income alongside deductions and superannuation, users can understand your earnings and assess affordability realistically.

Linking salary calculation with mortgage estimates allows people to manage income, track monthly expenses, and align repayments with financial goals.

Tools that show annual salary, monthly salary, and weekly salary projections make it easier to manage my budget while preparing for long-term commitments in Australia.

How Income and Salary Insights Support Smarter Decisions ?

Understanding salary structure plays a major role in mortgage planning. Using Simple Software to Calculate Salary or other digital tools allows users to calculate salary accurately, identify tax deductions, and determine take-home pay.

Many Australians rely on a user-friendly platform or online tool that works equally well as a desktop tool, offering instant results without complexity.

By reviewing actual income through a payroll calculation tool, borrowers gain clarity on net salary versus liabilities, helping them balance repayments with personal finance priorities.

Why Salary Awareness Matters Before Taking a Mortgage ?

Salary awareness reduces financial risk and improves long-term stability. When borrowers clearly understand gross income, net salary, and deductions, they can plan repayments without overcommitting.

Combining mortgage estimates with Simple Salary Calculators helps Australians align budgets, savings targets, and living costs. This method supports better payroll management and realistic planning for monthly expenses such as bills, rent alternatives, and lifestyle needs.

Tools like a Salary Budget Calculator help balance your take-home pay while setting achievable savings targets. For deeper income insights, readers can also explore our related guide on salary calculation and budgeting for Australian households to strengthen decision-making before applying for a loan.

Common Mistakes to Avoid

One common mistake is ignoring deductions and focusing only on headline income. Others underestimate taxes or rely on outdated figures instead of real-time financial tools. Some borrowers skip budgeting apps entirely, missing chances to track spending patterns.

Overestimating affordability without reviewing net salary or using australia mortgage calculators together with income tools can lead to repayment stress. Avoiding these errors helps protect long-term financial goals.

Releted Calculator:- Salary Sacrifice Calculator

FAQs

Q1:- How do Australians estimate mortgage affordability accurately?

A:- Australians usually review their income, track regular expenses, and use repayment estimates from budgeting apps or calculators to judge what they can realistically afford.

Q2:- Does salary structure affect mortgage approval?

A:- Yes, lenders assess salary stability, deductions, and net income to determine borrowing capacity and repayment reliability.

Q3:- Can budgeting apps help with mortgage planning?

A:- Yes, budgeting apps help people monitor spending, plan savings, and prepare for long-term mortgage commitments more effectively.

Q4:- What role does net income play in repayments?

A:- Net income shows actual take-home pay, which helps set safe and sustainable mortgage repayment limits.

Q5:- Are online calculators reliable for planning?

A:- When used correctly, online calculators provide quick estimates and support informed planning before approaching lenders.

Q6:- Should first-time buyers consider tax impacts?

A:- Yes, understanding taxes and deductions helps ensure mortgage repayments stay manageable within the Australian tax system.

Q7:- Where can I learn more about managing money in Australia?

A:- Government resources like MoneySmart provide reliable guidance on budgeting, borrowing, and financial planning in Australia.