Net Salary: —

Super Contribution: —

Total Deductions: —

Australian Salary Calculator 2026

Planning your income in Australia for the 2025–26 financial year requires more than guessing your paycheck. With changing Australian tax rates 2025–26, updated tax brackets Australia, and adjustments to superannuation Australia, understanding your real earnings Australia is essential.

An Australian Salary Calculator 2025–26 helps employees, freelancers, and contractors accurately estimate income after tax Australia, making financial decisions clearer and more reliable.

Whether you are switching jobs, negotiating a salary, or planning budgeting Australia, this online salary calculator Australia allows you to calculate take home pay Australia with precision. I

nstead of manually calculating Australian income tax, Medicare levy Australia, and salary deductions Australia, you can rely on a simple, automated solution that reflects the latest Australian tax data.

This guide explains how a salary calculator Australia works, why it matters in 2025–26, and how it can support mortgage planning Australia, loan affordability Australia, and long-term financial stability.

What Is an Australian Salary Calculator?

An Australian Salary Calculator is an online tool designed to estimate your Australian salary after tax by applying current Australian tax rates, Australian tax brackets, and mandatory deductions such as the Medicare levy and superannuation.

It shows net pay Australia, gross income, and real earnings after all statutory deductions.

A modern salary Australia calculator for 2025–26 considers updated tax rate updates Australia, super options Australia, and changes announced in the federal budget.

Some tools allow users to choose between an include super salary calculator or exclude super salary calculator, helping employees understand total compensation versus take-home income.

Australian Salary Calculation (Step-by-Step) ?

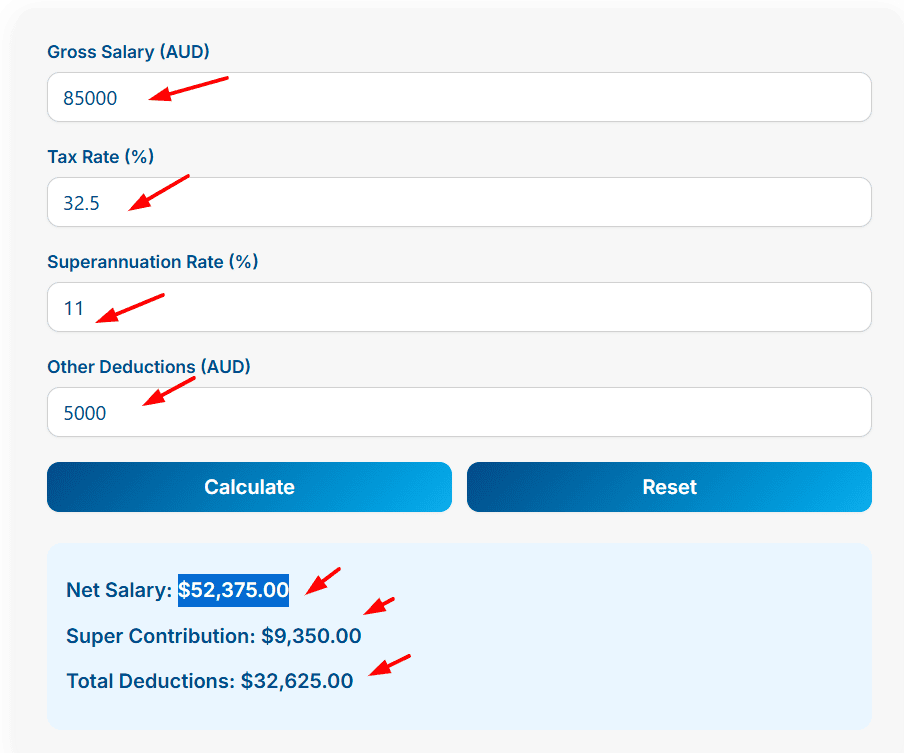

Suppose: An employee has a gross salary of AUD 85,000, a tax rate of 32.5%, a superannuation rate of 11%, and other deductions of AUD 5,000 — what would their estimated net salary, super contribution, and total deductions be?

Step 1: Enter Gross Salary

- Input your total annual salary in AUD.

- Example:

85,000

Step 2: Enter Tax Rate (%)

- Input the applicable tax rate for your income.

- Example:

32.5

Step 3: Enter Superannuation Rate (%)

- Input your superannuation contribution rate.

- Example:

11

Step 4: Enter Other Deductions

- Include any additional deductions (e.g., union fees, health insurance).

- Example:

5,000

Step 5: Click Calculate

- Press Calculate to instantly see:

- Net Salary: Gross Salary minus Tax and Other Deductions

- Super Contribution: Calculated from Gross Salary × Super Rate

- Total Deductions: Tax Amount + Other Deductions

Step 6: Optional Reset

- Click Reset to clear all fields and start again.

| Field | Value |

|---|---|

| Gross Salary | AUD 85,000 |

| Tax Rate | 32.5% |

| Super Rate | 11% |

| Other Deductions | AUD 5,000 |

| Net Salary | AUD 52,375 |

| Super Contribution | AUD 9,350 |

| Total Deductions | AUD 32,625 |

Notice:⚠️ Calculations shown are indicative and based on user-entered values. Results may differ due to tax rules, deductions, or individual circumstances. This tool is for informational purposes only.

How the Australian Salary Calculator Works?

An Australian Salary Calculator 2025–26 uses a structured calculation process based on official Australian tax brackets and income rules. First, the user enters their gross annual salary, hourly wage, or weekly earnings into the online salary calculator.

This salary calculator Australia then applies the relevant Australian income tax rates based on the 2025–26 tax year. The calculator automatically considers tax brackets Australia and applies marginal tax rates accordingly.

This ensures your Australian salary after tax reflects the correct income tax structure. Next, mandatory deductions such as the Medicare levy Australia are applied. For most taxpayers, this levy is calculated as a percentage of taxable income, though exemptions or reductions may apply in certain cases.

Superannuation Australia is another key component. Users can select super options depending on whether their employer pays super on top of salary or includes it within the package. An include super salary calculator shows total package value,

while an exclude super salary calculator focuses on take-home pay. This distinction is critical for accurate Australian net income calculator results. Once taxes and superannuation are calculated, the tool displays net pay Australia,

showing income after tax Australia on an annual, monthly, fortnightly, or weekly basis. Many tools also act as an Australian payroll calculator, helping employers and employees verify payslips and payroll accuracy.

Advanced calculators also help with budgeting with salary calculator features, allowing users to estimate net income for mortgage eligibility. This is especially useful for mortgage repayment planning, loan affordability, and understanding net income for mortgage applications.

Because the calculator uses updated salary calculator Australia logic, it reduces errors caused by outdated tax assumptions. Instead of spreadsheets or manual formulas, a simple salary calculator Australia ensures consistent, accurate results aligned with SuperGuide tax brackets and official tax policies.

This makes it one of the most reliable financial calculators Australia residents can use in 2025–26. Many users also compare this tool with an ATO salary calculator, salary pay calculator, or wages calculator Australia available online.

While an ATO-based calculator focuses strictly on tax estimation, an advanced salary calculator Australia works as an annual pay calculator, helping users understand total wages, deductions, and net income together.

This makes it easier to evaluate real earnings Australia and choose the most suitable calculator for personal budgeting and financial planning.

Who Should Use This Calculator?

The Australian earnings calculator is useful for full-time employees, part-time workers, freelancers, and contractors. It is also ideal for job seekers comparing offers, HR professionals managing payroll, and individuals planning buying a home Australia.

Anyone using an Australian Mortgage Calculator benefits from knowing accurate net income figures. If you are also calculating overtime, you may explore our internal guide on Australian overtime pay calculations for better income planning.

Common Mistakes to Avoid When Calculating Salary

Many people rely on outdated tax data or ignore Australian tax brackets updates. Others forget to include Medicare levy or misunderstand superannuation Australia contributions. Using a manual approach often leads to incorrect real earnings Australia estimates.

A reliable salary calculator 2025–26 avoids these mistakes and ensures compliance with the latest Australian tax data.

Releted Calculator:- Salary, Wages & Take home Pay Calculator Australia

FAQs

Q1:- What is the best Australian Salary Calculator 2025–26?

A:- The best Australian Salary Calculator 2025–26 is one that uses updated Australian tax rates, supports different super options Australia, and provides accurate net pay Australia instantly.

Q2:- Does the calculator include Australian tax rates 2025–26?

A:- Yes, a reliable updated salary calculator Australia applies the latest Australian tax rates 2025–26 and current Australian tax brackets automatically.

Q3:- Can I calculate income after tax Australia on a monthly basis?

A:- Yes, most salary calculator Australia tools allow you to view income after tax Australia annually, monthly, fortnightly, and weekly.

Q4:- Does this calculator help with mortgage planning Australia?

A:- Absolutely. Knowing your net income for mortgage applications helps with loan affordability Australia and mortgage repayment planning.

Q5:- Is superannuation Australia included in the calculation?

A:- Yes, users can choose between an include super salary calculator or exclude super salary calculator based on their employment structure.

Q6:- Is this calculator suitable for budgeting Australia?

A:- Yes, it is ideal for budgeting with salary calculator features and helps track real earnings Australia for better financial planning.

Q7:- Why should you use a Salary Calculator Australia?

A:- A salary calculator Australia makes income planning easy by estimating take-home pay using tools like an ATO salary calculator and salary pay calculator for quick and reliable results.

Q8:- When do workers need a wages calculator Australia?

A:- A wages calculator Australia is useful when tracking daily, monthly, or yearly income and also works as an annual pay calculator for clear salary breakdowns.

Q9:- Which tools help with yearly salary planning in Australia?

A:- An annual pay calculator, salary calculator Australia, ATO salary calculator, and salary pay calculator help workers plan income, taxes, and savings effectively.

Q10: What is an ATO net pay calculator used for?

A:- An ATO net pay calculator helps you estimate your take-home pay after tax, super contributions, and deductions in Australia. It shows how salary packaging, tax withholding, and salary sacrifice affect your net income.