Investment Results

Final Amount: $0.00

Total Principal Invested: $0.00

Total Interest Earned: $0.00

Compound Interest Calculator

Understanding how your money can grow over time is crucial for smart financial decisions. A Compound Interest Calculator is an essential tool that helps you see the long-term impact of saving and investing. By factoring in your initial deposit, interest rates, and the duration of investment,

this calculator gives a clear picture of how your wealth may increase over time. Whether you are saving for retirement, education, or other long-term goals, using such a tool allows for better planning and ensures you make informed financial choices.

Many Australians rely on calculators like Simple Salary Calculators to estimate their returns accurately.

What is a Compound Interest Calculator

A Compound Interest Calculator is an online tool that calculates interest earned not just on the initial principal but also on accumulated interest from previous periods. Unlike simple interest, this method accelerates your financial growth over time.

For Australians, the Compound Interest Calculator Australia helps visualize how monthly contributions or annual deposits can amplify savings and investments. These calculators are useful for employees, investors, or students planning to grow their wealth efficiently.

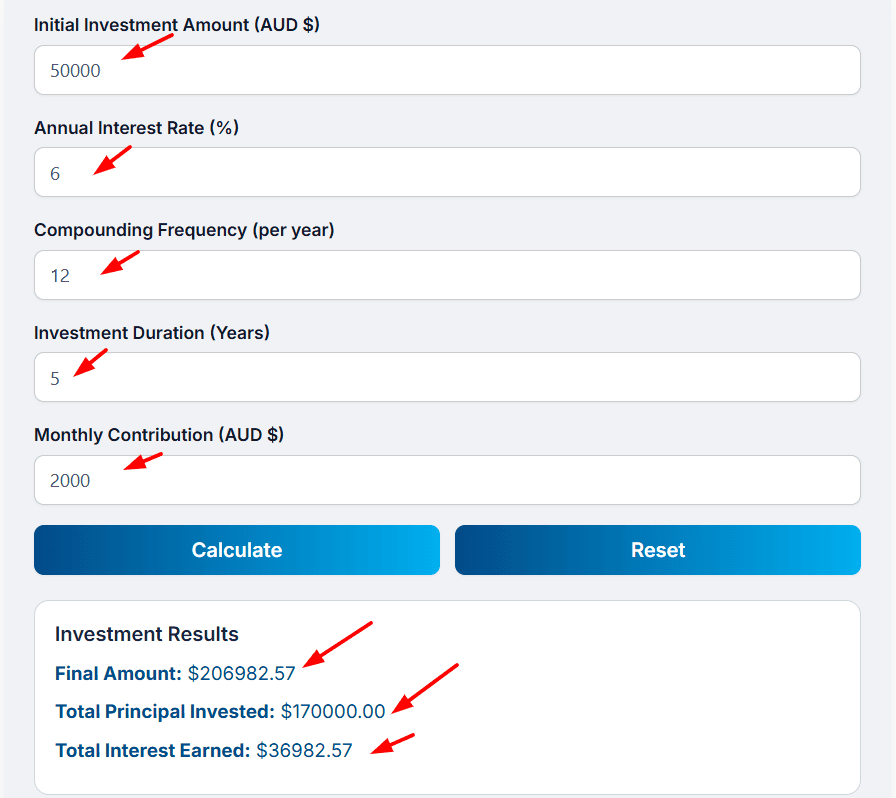

Compound Interest Calculation (Step-by-Step) ?

Suppose: You invest ₹50,000 as the initial principal, with an annual interest rate of 6%, compounded monthly for 5 years, and contribute ₹2,000 every month — what would your estimated total investment grow to?

Step 1: Enter Principal Amount

- Principal Amount: ₹50,000

Step 2: Enter Annual Interest Rate

- Interest Rate: 6%

Step 3: Enter Times Interest is Compounded Per Year

- Compounded Monthly: 12

Step 4: Enter Investment Duration

- Duration: 5 years

Step 5: Enter Monthly Contribution (Optional)

- Contribution: ₹2,000 per month

Step 6: Click Calculate

- Press Calculate to see results

Step 7: View Results

- Final Amount: $206982.57

- Total Principal Invested: $170000.00

- Total Interest Earned: $36982.57

Step 8: Reset Form (Optional)

- Press Reset to clear all fields

Common Scenarios and Planning Ahead

You might use a Compound Interest Calculator when planning for retirement, education fees, or buying property. For example, if you want to see how monthly deposits of $500 grow over 20 years at a fixed interest rate, the calculator provides precise projections.

Another scenario involves adjusting contribution levels to meet long-term goals. Using tools like the Take Home Pay Calculator helps you understand disposable income that can be invested for compounded growth. Planning ahead ensures your financial growth stays on track and prevents last-minute financial stress.

Why Use a Compound Interest Calculator ?

Understanding compound interest is vital for long-term financial planning. Many people underestimate how even small, consistent investments can multiply over time. By using this calculator, you gain insights into potential earnings, helping you set realistic goals and avoid short-term thinking.

It also supports better budgeting, ensuring you allocate funds wisely without compromising lifestyle. For beginners, visualizing how interest accumulates can motivate disciplined savings. Moreover, accurate projections reduce the risk of financial surprises and allow investors to explore different strategies to maximize returns.

Overall, it is an indispensable tool for anyone seeking financial independence.

Common Mistakes

Many users make errors like entering incorrect interest rates, forgetting to adjust for compound frequency, or underestimating inflation. Others rely solely on initial projections without revisiting the plan periodically.

Another common mistake is ignoring tax implications on earnings or failing to consider changes in contributions over time. Ensuring accuracy requires double-checking all inputs and reviewing calculations regularly.

By avoiding these mistakes, your long-term financial growth projections remain realistic and reliable.

Example Calculation

Suppose you start with an initial investment of AUD 10,000 and contribute AUD 200 every month at an annual interest rate of 5% for 15 years. With the Compound Interest Calculator Australia, you can easily forecast the growth of your investment over time, taking full advantage of compounding.

This estimate provides a clear picture of how disciplined, regular savings can help you reach long-term financial goals. Using the calculators from Simple Salary Calculators ensures precise results and empowers smarter planning for your future finances in Australia.

Releted Calculator:- Australian Mortgage Calculator

FAQs

Q:1- What is the difference between compound and simple interest?

A:- Compound interest adds interest on both the principal and accumulated interest, while simple interest is calculated only on the principal. Compound interest grows faster over time.

Q:2- How often should I use a Compound Interest Calculator?

A:- It’s best to review calculations annually or when making significant contributions to adjust projections and ensure your financial growth aligns with goals.

Q:3- Can taxes affect compound interest calculations?

A:- Yes, taxes on earned interest reduce overall returns. Calculators provide pre-tax estimates, so you should factor in local taxation for realistic projections.

Q:4- Is monthly or yearly compounding better?

A:- More frequent compounding (monthly vs yearly) increases total earnings. Using calculators allows you to test different scenarios and optimize savings.

Q:5- Can I combine this with a Take Home Pay Calculator?

A:- Yes, understanding disposable income helps determine how much you can invest for maximum compound interest growth without affecting lifestyle.

Q:6- Will inflation affect the projected growth?

A:- Inflation reduces the real value of savings over time. Using compound interest calculations alongside financial planning strategies ensures long-term goals are realistic.

Q:7- Is it safe to rely on online calculators?

A:- Yes, reputable tools like Simple Salary Calculators provide reliable estimates. Always double-check input values for accuracy and cross-reference results if needed.