Taxable Income after Salary Sacrifice:

Employer Super Contribution:

Estimated Tax Savings:

Simple Salary Sacrifice Calculator

Managing income efficiently is no longer just about knowing your paycheck; it’s about making informed decisions that support future goals. Many professionals today look for smarter ways to optimise earnings, reduce tax pressure, and plan benefits without added complexity.

That’s where a Simple Salary Sacrifice Calculator becomes valuable. Designed to simplify decision-making, it helps users understand how adjusting income components can influence take-home results. Whether you are planning benefits, preparing for upcoming expenses, or comparing scenarios,

this approach brings clarity. Instead of guesswork, it offers structured insight into how salary changes affect savings, lifestyle choices, and long-term stability, making financial decisions more confident and less stressful.

What Is a Simple Salary Sacrifice Calculator ?

A salary sacrifice calculator is a digital solution that explains how a salary sacrifice arrangement works in Australia by converting part of your gross income into benefits. As an intuitive tool,

it shows how pre-tax income exchanged for non-cash benefits such as super contributions or car leases can influence net salary.

Many people compare it with a salary sacrifice calculator Australia or an ATO salary sacrifice calculator to understand taxable income changes and final take-home pay with confidence.

How To Calculate Simple Salary Sacrifice Calculator ?

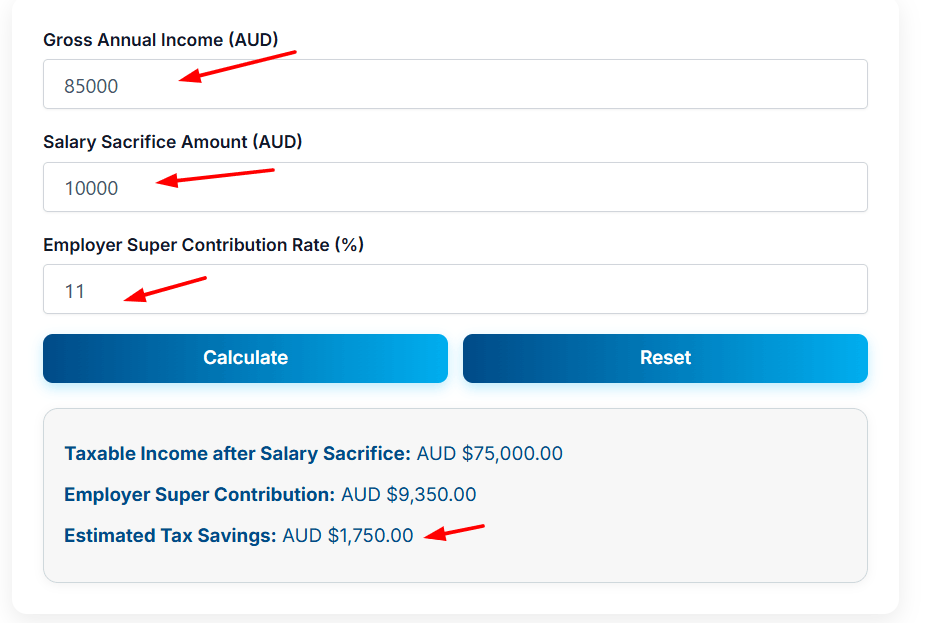

Single employee, annual income AUD 85,000, salary sacrifice AUD 10,000, employer super rate 11% → Estimated reduced taxable income and tax savings shown instantly.

Salary Sacrifice Calculator – Step-by-Step

Step 1: Enter Gross Annual Income

Input: AUD 85,000

This is your total yearly salary before tax and before salary sacrifice.

Step 2: Enter Salary Sacrifice Amount

Input: AUD 10,000

This amount is taken from your pre-tax income and redirected to benefits like super.

Step 3: Enter Employer Super Contribution Rate

Input: 11%

This is the percentage your employer contributes to superannuation.

Step 4: Click on “Calculate”

The calculator instantly processes the details using standard tax assumptions.

Calculator Output (Result)

Gross Income: AUD 85,000

Salary Sacrificed Amount: AUD 10,000

Taxable Income after Salary Sacrifice: AUD 75,000

Employer Super Contribution (11%): AUD 9,350

Estimated Tax Savings: AUD 1,750 (approx.)

What This Means for the User

• Your taxable income is reduced, which can lower overall tax

• More money goes toward super or benefits instead of tax

• You clearly see the before-and-after impact in one place

Notice This calculator provides estimates only. Actual tax savings, super contributions, and outcomes may vary based on personal tax situation, current tax laws, and employer policies. To ensure accurate financial planning, consider getting guidance from a certified tax agent or professional financial adviser.

Common Scenarios and Planning Ahead

Employees often use planning tools when evaluating long-term savings, budgeting commitments, or comparing before-and-after pay visualization. By entering deductions into a simple salary calculator or software salary tool,

users can see how vehicle arrangements or salary packaging calculator options affect monthly outcomes. HR teams also rely on an HR professional salary tool to guide employee financial planning, especially when Australian tax rates and salary sacrifice tax updates change.

Examples of Salary Sacrifice in Practice

In real-world use, tools such as a salary sacrifice super calculator or salary sacrifice super contributions calculator help forecast retirement benefits. For transport needs, a car salary sacrifice calculator or novated lease calculator explains the cost impact of novated leases.

These examples highlight how salary sacrifice outcomes can lower taxable income while maintaining lifestyle flexibility.

Why Use This Calculator ?

Choosing the right structure for income requires more than intuition. A financial planning tool allows employees and employers to evaluate salary packaging objectively. By reviewing take-home pay through a free salary calculator or super contributions calculator,

users gain transparency and confidence. This approach supports financial planning, aligns with compliance requirements, and helps calculate salary sacrifice outcomes accurately. It also acts as a calculator to decide on salary sacrifice suitability, ensuring decisions are informed, realistic, and aligned with long-term priorities rather than short-term assumptions.

Common Miss-steps to Avoid

A frequent mistake is ignoring deductions while focusing only on headline salary numbers. Others forget to factor in salary packaging or rely on outdated assumptions instead of updated Australian tax rates.

Using a software salary tool free without reviewing gross income calculator results can also lead to incorrect expectations about net salary and take-home pay calculator accuracy.

Releted Calculator:- Car Salary Sacrifice Calculator

FAQs

Q1:- Who should use a salary sacrifice calculator?

A:- Employees and employers exploring benefit options, super contributions, or vehicle arrangements can use it to support accurate financial planning.

Q2:- Does it work for different income levels?

A:- Yes, it adapts to varying gross income, deductions, and salary sacrifice suitability across roles and industries.

Q3:- Can it help with long-term budgeting?

A:- Absolutely, it supports long-term savings strategies and employee financial planning decisions.

Q4:- Is it suitable for HR teams?

A:- Yes, many HR departments use it as part of a Simple Salary Calculators tool for internal guidance.

Q5:- Are tax updates reflected accurately?

A:- Reliable tools follow salary sacrifice tax updates and current Australian tax rates automatically.

Q6:- Can it be used alongside other calculators?

A:- It complements tools like a software salary tool and internal resources such as a salary planning guide.

Q7:- Where can I learn more about official guidance?

A:- You can refer to the MoneySmart guide for government-backed information.

Q8:- How to calculate superannuation salary sacrifice?

A:- You can use a superannuation salary sacrifice calculator or super calculator salary to quickly estimate your contributions, tax savings, and future super balance. Just enter your salary and sacrifice amount for an instant calculation.